Major Bank Digital Transformation

The Challenge

A major banking institution with over 10 million customers was struggling with legacy systems that couldn't keep up with the demands of modern digital banking. Their existing infrastructure was:

- Built on monolithic architecture that was difficult to update and scale

- Suffering from slow performance during peak usage times

- Unable to integrate with modern fintech solutions

- Costly to maintain and update

The bank needed a complete digital transformation to remain competitive in an increasingly digital financial landscape while ensuring the highest levels of security and compliance.

Our Approach

We worked closely with the bank's leadership and IT teams to develop a comprehensive digital transformation strategy. Our approach included:

1. Assessment and Planning

We conducted a thorough assessment of the existing systems, identifying pain points, dependencies, and opportunities for improvement. This allowed us to create a detailed roadmap for the transformation process.

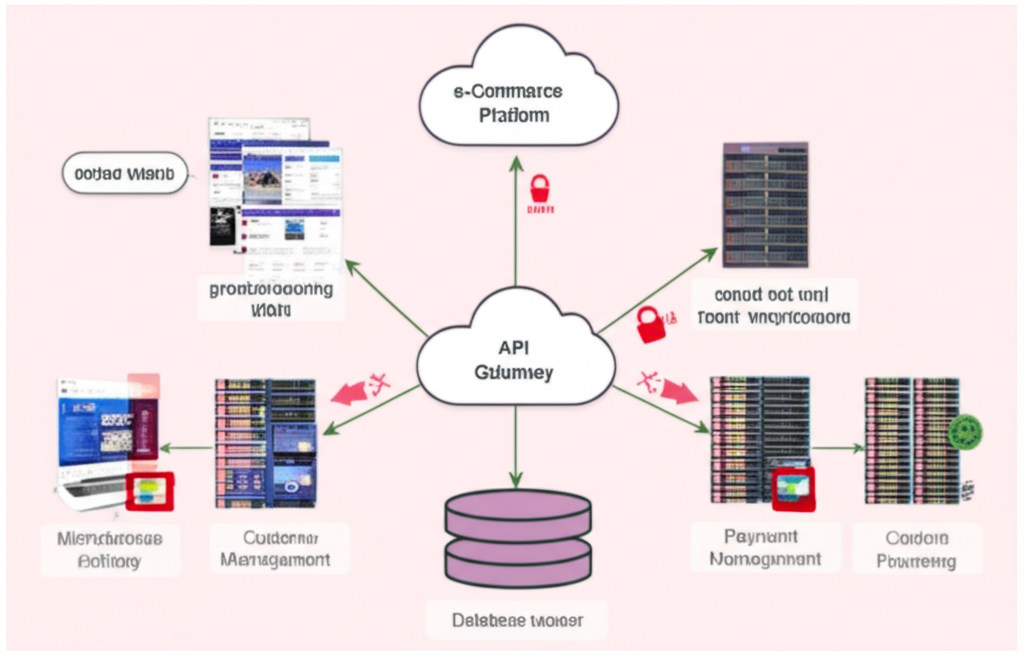

2. Microservices Architecture

We redesigned the bank's core systems using a microservices architecture, breaking down the monolithic application into smaller, independently deployable services. This approach enabled:

- Greater flexibility and scalability

- Faster deployment of new features

- Improved fault isolation

- Better resource utilization

3. API Development

We developed a comprehensive API layer that allowed for seamless integration with both internal systems and external partners. This API-first approach enabled the bank to:

- Easily connect with fintech partners

- Support mobile and web applications with a unified backend

- Create new revenue streams through banking-as-a-service offerings

4. Cloud Migration

We migrated appropriate systems to a hybrid cloud environment, balancing the benefits of cloud computing with the security requirements of banking regulations. This included:

- Implementing a secure cloud architecture

- Setting up automated scaling to handle peak loads

- Establishing robust disaster recovery procedures

- Ensuring compliance with financial regulations

The Results

The digital transformation delivered significant benefits to the bank and its customers:

40%

Reduction in operational costs

60%

Faster time-to-market for new features

99.99%

System availability

30%

Increase in mobile banking adoption

Beyond the numbers, the transformation enabled the bank to:

- Launch innovative new products and services

- Provide a seamless omnichannel experience for customers

- Better compete with digital-first financial institutions

- Attract a younger demographic of customers

Conclusion

This digital transformation project demonstrates how traditional financial institutions can modernize their technology stack to meet the demands of today's digital-first customers while maintaining the security and reliability expected in the banking sector.

By embracing microservices, APIs, and cloud technologies, the bank was able to transform from a legacy institution into a modern, agile financial services provider ready to compete in the digital age.